Proceeds Of Acceleron $150 Million Stock Offering To Fund Muscular Dystrophy Drug Development

by |

Cambridge, Massachusetts based clinical stage biopharmaceutical company Acceleron Pharma Inc. has announced its intent to offer and sell, subject to market and other conditions, $150 million of the company’s common stock in an underwritten public offering.

Acceleron intends to use net proceeds from the offering partly to conduct clinical trials and associated activities in connection with ACE-083, Acceleron’s investigational clinical stage protein therapeutic candidate designed for local administration to promote muscle mass growth, strength, and function in specific targeted muscles and muscle groups.

Acceleron is developing ACE-083 as a treatment for diseases in which improved muscle strength may provide a clinical benefit, such as inclusion body myositis and certain forms of muscular dystrophy. Persons with these disorders frequently suffer from a severe clinical course that may ultimately lead to inability to walk or perform other daily tasks, such as eating or getting dressed, without assistance.

The company observes that there is currently no effective treatment for many diseases involving loss of muscle mass and strength, and ACE-083 is designed to promote muscle growth selectively in those muscles in which the drug is administered. The company projects that in conditions where muscle loss or atrophy is limited to specific muscle groups, a locally-acting agent that increases muscle size and function could provide significant clinical benefit.

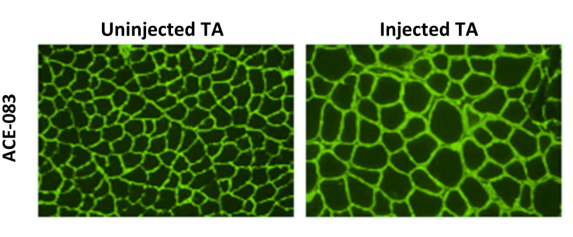

A recent study presented in the Late Breaking Clinical Trials Session at the 8th International Conference on Cachexia, Sarcopenia, and Muscle Wasting held in Paris, France, December 4-6, 2015 entitled “Phase 1 dose escalation study of ACE-083 in healthy volunteers: Preliminary results for a locally acting muscle therapeutic“ was led by Susan S. Pandya MD, Senior Director of Medical Research at Acceleron Pharma. The researchers found that in both wild type (WT) and the mdx mouse model of Duchenne muscular dystrophy (DMD), local injection of ACE-083 led to localized muscle hypertrophy as well as dose-dependent increases in muscle mass.

(Images Courtesy Acceleron)

The study investigators concluded that ACE-083 injected into the rectus femoris (RF) muscle is associated with a favorable safety profile and resulted in dose-dependent and significant increases in RF muscle volume, and maintain that these encouraging data support further studies of ACE-083 in a variety of muscle diseases, such as Facioscapulohumeral muscular dystrophy (FSHD) and Duchenne Muscular Dystrophy

Some of the proceeds from Acceleron’s stock offering will also go to development of the company’s other potential therapeutic candidates, including antibodies and proteins from its IntelliTrap drug discovery platform from which it is creating a large and diverse library of new, selective therapeutic candidates targeting the TGF-beta superfamily. This platform has already generated several new therapeutic candidates including ACE-2494, a systemic muscle therapeutic and the first clinical candidate to emerge from this platform. Acceleron aims to initiate its first clinical trial of ACE-2494 by the end of 2016.

The balance of the stock issue proceeds will be utilized to further expand Acceleron’s research and development efforts, and for general and administrative expenses, potential future development programs, capital expenditures and working capital and other general corporate purposes.

As part of this offering, Acceleron says it intends to grant the underwriters a 30-day option to purchase up to an additional fifteen percent of the number of shares sold. All of the shares in the offering are to be sold by Acceleron.

Morgan Stanley, Leerink Partners LLC and UBS Investment Bank are acting as joint book-running managers for the offering. JMP Securities is acting as the lead manager.

The offering will be made only by means of a preliminary prospectus supplement and accompanying prospectus, copies of which may be obtained, when available, from Morgan Stanley, Attention: Prospectus Department, 180 Varick Street, 2nd Floor, New York, NY 10014; Leerink Partners LLC, Attention: Syndicate Department, One Federal Street, 37th Floor, Boston, MA, 02110, or by e-mail at [email protected], or by phone at 800-808-7525, ext. 6142; and UBS Securities LLC, 1285 Avenue of the Americas, New York, New York 10019, Attention: Prospectus Department, or by phone at 1-888-827-7275. The final terms of the offering will be disclosed in a final prospectus supplement to be filed with the SEC.

Sources:

Acceleron